PAGEV President Mr. Yavuz Eroğlu, on his call to "stop purchases" from petrochemical companies that drove their prices up by over 150% with plant shutdowns: “Our boycott drove prices down by 15% in domestic market.”

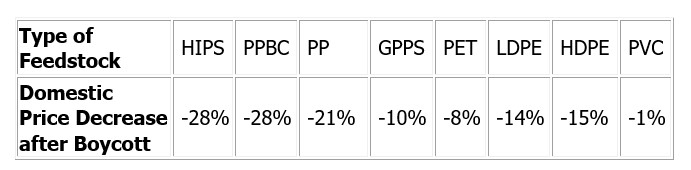

The decision of manufacturers to "boycott" virgin polymers, paid off. After calling producers to stop buying polymers in response to the speculative increase in prices, PAGEV stated that purchases in the domestic market has almost stopped. Saying that figures suggested widespread participation in the call to boycott, Eroğlu stated: "We started the boycott in the second half of March and prices declined by about 15% shortly afterwards in domestic market. Considering that Turkey uses some 600,000 tons of raw material per month, the 15% average reduction means a saving of 180 million dollars."

NEW PETROCHEMICAL CAPACITIES IN CHINA WILL ACCELERATE THE FALL

Saying that Plastics Manufacturers would continue to resist astronomical price increases pushed by the suspiciously synchronized shutdowns of petrochemical companies , Eroğlu continued: “Turkey is one of the largest polymer importers globally and Turkish Plastics manufacturers will continue to hold out until June, when new petrochemical facilities will come online in China, which is the world's largest plastics raw material importer, and there will be an abundance of feedstock that will further drive prices down. The boycott will help to deflate the speculative price bubble with the greatly enhanced supply in China after June”

THE BOYCOTT WILL CONTINUE

Eroğlu said that they would continue to work with minimal inventory and hold off purchases until June, and that while 15% price fall was a good start, it was a fraction of the 150% price hike, continuing: "Plastics manufacturers that had to shut off production lines because of astronomical prices are getting their hopes back up. We will continue to hold out as long as we can and help return small and medium businesses that had to shutter back to production. The steps we take on have begun to pay off. As a stopgap measure, we had asked PETKİM (local integrated petrochemical company) to allocate its entire production to the domestic market. We asked the government for the removal of taxation and protectionist measures on plastic raw material imports,. Meanwhile, we called manufacturers to use recycled feedstocks as much as possible. In addition to these short-term measures, we are working with public authorities and the society to encourage the Turkey Wealth Fund to prioritize the petrochemical facility investment on which tangible work is being done. We are working with all industry stakeholders to bring a solution to the raw material price issue."

EXCUSES FOR SHUTDOWNS AND HIGH PRICES ARE UNSATISFACTORY

Meanwhile, petrochemical companies argue that raw material prices climbed to this peak due to the increase in freight charges. However, most of the plants based in Europe and Turkey are integrated plants that make their own key input components. Some of them also obtain a significant portion of feedstock from the refinery that is on the same property, owned by the same parent company. Freight charges are more of a concern for foreign petrochemical companies based in the Far East that sell to Europe and Turkey, not the local ones. To the contrary, if freight is an issue, the foreign competitor is at a disadvantage against the local petrochemical plants. Therefore, we are at a loss as to why Petrochemical plants use freight charges as a pretext for increasing raw material prices. The argument of freight charges driving raw material prices higher as brought forward by petrochemical companies is exactly why their prices should remain lower than that of their far east competitors. The science of mathematics and economics militate that local petrochemical companies, operating right locally, incur less freight charges than a Far Eastern company that ships its products halfway across the world to Europe.

Associating the increase in raw material prices with the increase in the price of petroleum is also an incoherent argument as the increase in raw material prices primarily depends on supply and demand. In 2018, when a barrel of petroleum was around 60 USD, PVC was selling for 1000 USD/ton spot; just 4 weeks ago, the price of oil is roughly the same, but spot PVC sells for 2100 USD/ton in spot. Its price has more than doubled when oil has stayed the same. This is why petroleum prices cannot explain the hike in raw material prices.

Petrochemical companies also claim that the prices of raw materials have increased because of the bad weather in Texas. This argument does not explain the whole story. Petrochemical companies in the US, Europe and elsewhere have been declaring force majeures or halting production due to various reasons since November, and the synchronicity of these force majeures or supply shortages cannot be verified by statistics or science of probability. Considering that the industry has been targeted by competition authorities worldwide for creating price cartels in the past, a coincidental shutdown/force majeures that had inevitably lead to price increases is enough to give the suspicion of an organized deal. Otherwise, it is of course possible that a natural disaster like the one in Texas leads to force majeure of some facilities, but cannot be the only explanation why so many closures happen in very short time and simultaneously all around the world.

Another explanation offered by petrochemical companies is that companies in the Far East are buying their products and they are out of stocks to serve domestic markets. This makes no sense either as the same raw materials are available in the Far East for far cheaper: For example, the price of spot PP in is 1850 USD/ton in Turkey while in China the price is 1300 USD/ton. Why would a Petrochemical company sell the same raw material to China for cheaper? What explains some petrochemical companies selling at very cheap prices to China whereas they can sell for much higher to Turkey & Europe?

Petrochemical companies also state pandemic recovery as a reason: Prices increase because the economy is beginning to recover. This is unsatisfactory. Feedstock prices are way above the December 2019 level, when the pandemic did not exist and it was business as usual. How can the prices be even higher now, when economic activity is not yet back to normal, the entire service industry including tourism is shut down, and restrictions continue? There can only be one reason: Shortage of supply caused by petrochemical facilities being taken offline by petrochemical companies for various excuses.

Petrochemical companies claim that the price increase is also due to the use of medical supplies for Covid-19 prevention. This contradicts available data. Medical supplies account for less than 5% of the consumption of the plastics industry. Claiming that prices are going up because of medical supplies does not fit in with reality.

As a conclusion, we look for fair market for both petrochemical companies and plastics manufacturers. As manufacturers we are using our purchasing power to balance the market that has become unbalanced by the shutdowns of petrochemical companies with our boycott . But it is also obvious under this conditions that market regulation and control authorities should waste no more time checking the situation.

Contact: PAGEV Corporate Communication Director Cesur Çaça cesur.caca@pagev.net.tr

Press Release Attachments Links

3. PAGEV President Mr. Yavuz EROGLU (Photo)

ABOUT PAGEV

PAGEV is one of the leading nongovernmental organizations in Turkey focusing on the Plastics Industry. PAGEV is composed of over 800 trustees and relevant 1750 member companies that account for more than 88% of the plastics value chain in Turkey.

The Turkey plastics industry makes a significant contribution to the welfare in Turkey by enabling innovation, creating quality of life to citizens and facilitating resource efficiency and climate protection. More than 300 thousand people are working in about 11,000 companies (mainly small and medium sized companies in the plastic sector) to create a turnover in excess of 34 billion $ per year. The value chain represented by PAGEV includes polymer manufacturers, product manufacturers, equipment builders and casting companies.

PlastEurasia Istanbul, the largest annual international plastics industry fair in Turkey and Eurasia, and the second largest event of its kind in the world, is held with the partnership of PAGEV and TÜYAP Fairs.

PAGEV have built vocational schools in Turkey in pursuit of our education mission, where we support an employment-based education model and help to meet the need for well-trained technical personnel in the industry. The PAGEV Küçükçekmece Vocational High School has a capacity of 1500 students while the PAGEV Gebze Vocational High School has 500.

Our subsidiary organization PAGÇEV has been supporting the recycling industry since January 2014 to fulfill its mission of "Responsible industry, problem-free environment." PAGÇEV, the Recycling Economic Entity of PAGEV, is an Authorized Institution of the Ministry of Environment and Urban Planning for segregation of packaging wastes at source to improve recycling performance. PAGÇEV undertakes the recycling and documentation requirements of businesses that market packaged products in Turkey, and cooperates with municipal facilities to enable the segregation and recycling of packaging wastes at the source. The organization also conducts education and awareness campaigns on packaging wastes and recycling, encourages recycling activities, and prepares public service announcements.